What is life insurance and its benefits in the US? Although life insurance is no longer unfamiliar to most people, questions such as "What is life insurance?", "What is its nature?", "What types of life insurance exist?", and "What benefits does it offer?" still remain unclear to many.

Life insurance is a product offered by insurance companies designed to provide financial protection against risks related to health, physical injury, or death. Simply put, the policyholder agrees to pay regular premiums into a financial reserve managed by the insurance company. In return, the insurer commits to paying out a specified amount in the event of unforeseen incidents or at the maturity of the policy.

What is life insurance and its benefits in the US?

According to Article 12, Clause 1 of the Law on Insurance Business:

A life insurance contract is an agreement between the policyholder and the insurer, whereby the policyholder is obliged to pay insurance premiums, and the insurer is obliged to pay out benefits to the beneficiary or provide compensation to the insured person upon the occurrence of an insured event.

The core purpose of life insurance is to serve as a safe financial safeguard for the future, primarily aimed at replacing income in the event that the insured individual faces unexpected adversity.

Therefore, life insurance plays a crucial role in life. It not only helps maintain stability during times of crisis but also serves as a means of risk-sharing within a community, by pooling funds from many to support the few who are affected.

According to Article 3, Clause 12 of the Law on Insurance Business, the main types of life insurance include:

Endowment Insurance: This covers the insured person in case they live to a specified date. The insurer will pay the benefit to the beneficiary if the insured is alive at the agreed-upon maturity date.

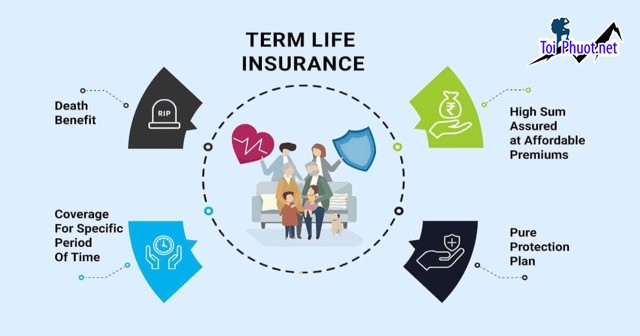

Term Life Insurance: This provides coverage in the event of the insured's death within a defined period. If the insured dies during this term, the insurer pays the benefit to the beneficiary.

Annuity Insurance: This applies if the insured survives to a specified point in time. After that point, the insurer pays periodic payments to the beneficiary, as stipulated in the contract.

Mixed Insurance: A combination of endowment and term insurance.

Whole Life Insurance: This provides lifetime coverage, meaning the benefit is paid whenever the insured person passes away, regardless of age.

In practice, to make it easier for customers to understand and choose suitable plans, insurance providers often categorize their products based on financial needs. For instance, Manulife’s life insurance offerings include whole life coverage, health insurance, education savings plans, retirement savings, and investment-linked products.

Despite growing interest, many people still misunderstand life insurance products and benefits, leading to unnecessary confusion. So, what does it mean to truly understand life insurance?

Although life insurance can generate returns similar to savings, its primary function is to protect against unforeseen risks. Thus, its profitability is usually not as high as that of savings accounts or investment channels.

It is, therefore, inappropriate to compare life insurance with savings in terms of returns. Instead, identify your needs—whether for risk protection or income growth—and choose accordingly based on the benefits offered by your policy.

What is life insurance and its benefits in the US?

The future is unpredictable. Planning ahead is crucial. Life insurance is one of the most effective long-term financial safeguards, especially as risks tend to increase with age. Choosing a whole life insurance policy ensures that you and your loved ones remain protected regardless of when a risk may occur.

Life insurance is intrinsically linked to unexpected risks—unpredictable events that result in loss, injury, or death. However, not all risks are covered.

Only those risks that occur accidentally and cause harm during the policy's validity period are eligible for benefits. Insurers do not cover intentional acts, pre-existing conditions, or events occurring before the policy becomes effective unless they are disclosed and accepted by the insurer.

No insurance product—including life insurance—covers every risk. There are limitations and exclusions, which is why it is vital to understand exactly what is covered, in what scenarios the benefits apply, and under what conditions the insurer may deny payment.

For example, insurance will not pay out in cases such as:

Death by suicide within two years of the policy start date

Death caused by criminal activity or capital punishment

HIV/AIDS-related death

Self-inflicted injuries or illegal acts

Pre-existing health conditions (unless disclosed and accepted)

What is life insurance and its benefits in the US?

Understanding the definition of life insurance may be easy, but to fully grasp its nature, types, benefits, and limitations requires careful attention. Before purchasing a policy, take time to understand:

What life insurance really offers

How different providers and plans vary

Which risks are covered

And what your own financial goals are

Having the right knowledge will help you make a confident, well-informed decision—and avoid any future misunderstandings.

Nguồn tin: www.manulife.com. vn

Những tin mới hơn

Những tin cũ hơn

Cho Thuê Lều Du Lịch Giá Rẻ Ở Tại Phú Yên

Cho Thuê Lều Du Lịch Giá Rẻ Ở Tại Phú Yên

![[Flycam] Núi Đá Bia, điểm du lịch sinh thái ở Phú Yên](/assets/news/2016_10/nui-da-bia-diem-du-lich-sinh-thai-o-phu-yen13.jpg) [Flycam] Núi Đá Bia, điểm du lịch sinh thái ở Phú Yên

[Flycam] Núi Đá Bia, điểm du lịch sinh thái ở Phú Yên

Ngẩn Ngơ Vẻ Đẹp Tinh Khôi Của Hot Girl Tú Linh Khi Diện Áo Cưới

Ngẩn Ngơ Vẻ Đẹp Tinh Khôi Của Hot Girl Tú Linh Khi Diện Áo Cưới

Cho thuê loa kẹo kéo vali du lịch giá rẻ tại Tuy Hòa - Phú Yên

Cho thuê loa kẹo kéo vali du lịch giá rẻ tại Tuy Hòa - Phú Yên

Spa ở tại Tuy Hòa Phú Yên bạn nên chọn để làm đẹp và chăm sóc da

Spa ở tại Tuy Hòa Phú Yên bạn nên chọn để làm đẹp và chăm sóc da

Địa Điểm Chụp Ảnh Cưới Đẹp Ở Phú Yên

Địa Điểm Chụp Ảnh Cưới Đẹp Ở Phú Yên

Thuê Xe Máy Tuy Hòa - Thuê Xe Máy Phú Yên Giá Rẻ

Thuê Xe Máy Tuy Hòa - Thuê Xe Máy Phú Yên Giá Rẻ

Cây hoa đào, mai, liễu đèn led, thanh lý giá rẻ toàn quốc

Cây hoa đào, mai, liễu đèn led, thanh lý giá rẻ toàn quốc

Suối nước khoáng Phú Sen, điểm du lịch nghĩ dưỡng ở Phú Yên

Suối nước khoáng Phú Sen, điểm du lịch nghĩ dưỡng ở Phú Yên

Áo cưới Phú Yên Sang Trọng Quyến Rũ

Áo cưới Phú Yên Sang Trọng Quyến Rũ

5 quán Nem Nướng Nha Trang Nhà Bè ăn là ghiền Sài Gòn Hồ Chí Minh

5 quán Nem Nướng Nha Trang Nhà Bè ăn là ghiền Sài Gòn Hồ Chí Minh

5 quán Nem Nướng Nha Trang Cần Giờ ăn là ghiền Sài Gòn Hồ Chí Minh

5 quán Nem Nướng Nha Trang Cần Giờ ăn là ghiền Sài Gòn Hồ Chí Minh

5 quán Nem Nướng Nha Trang Củ Chi ăn là ghiền Sài Gòn Hồ Chí Minh

5 quán Nem Nướng Nha Trang Củ Chi ăn là ghiền Sài Gòn Hồ Chí Minh

5 quán Nem Nướng Nha Trang Hóc Môn ăn là ghiền Sài Gòn Hồ Chí Minh

5 quán Nem Nướng Nha Trang Hóc Môn ăn là ghiền Sài Gòn Hồ Chí Minh

5 quán Nem Nướng Nha Trang Bình Chánh ăn là ghiền Sài Gòn Hồ Chí Minh

5 quán Nem Nướng Nha Trang Bình Chánh ăn là ghiền Sài Gòn Hồ Chí Minh